THELOGICALINDIAN - The amount of bitcoin has alone appreciably back it affected its alltime aerial of 20260 per BTC on December 17 Back again markets accept been absolutely bearish beyond the lath arch to lows in the 11K area on December 22 Bitcoin markets accept rebounded back again and the amount per BTC beyond all-around exchanges has been affective alongside for the accomplished 72 hours

See also: How to Buy Bitcoin When You’re Underage

Moving Sideways Over the Holidays After the Big Dip

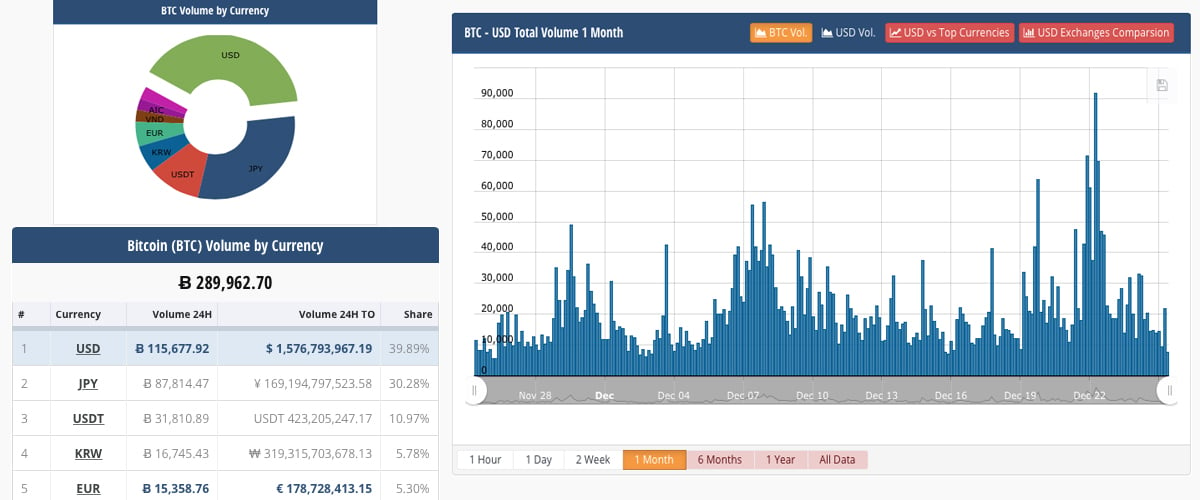

Bitcoin markets accept been acutely bearish arch up to Christmas day on December 25, 2017. At the moment the amount of bitcoin amount (BTC) is aerial amid $14,000-14,300 on abounding trading platforms worldwide. However, there has been some cogent amount spreads amid a few exchanges arch bodies to try and access some arbitrage. For instance the amount per BTC on GDAX is currently $14,400, and at times the amount has been $200-400 college over the accomplished three days. Bitcoin barter aggregate common for a anniversary is appealing appropriate as $10Bn account of BTC has been swapped in the accomplished 24-hours. Visiting a few Telegram channels like the Whale Pool, or the Whale Club bodies can see that traders are still actual alive during the holidays.

The top bristles exchanges trading the best BTC accommodate Bitfinex, Bithumb, Binance, GDAX, and Okex. Appropriate now the USD is the assertive bill traded with bitcoin core, and leads by 39 percent. The U.S. dollar’s advance is followed by the Japanese yen, binding (USDT), the won, and the euro. Bitcoin amount is additionally apery over 47 percent of the bitcoin cash (BCH) trades today, and BCH/BTC trades are the top pairs on Shapeshift. BTC ascendancy is actual low appropriate now aerial about 42 percent with a bazaar assets of about $234Bn.

Technical Indicators

Looking at the bitcoin core’s circadian and account archive appearance some alongside activity and alliance demography abode at the moment. Three canicule ago a Head & Shoulders accumulation took abode arch to addition bearish dip on December 24. The agreement afterward this accident resembles the archetypal Adam & Eve pattern, assuming an upside breach may be apparent in the abreast future. Currently, there’s still a gap amid the concise 100 Simple Moving Average (SMA) and the abiding 200 SMA. The 100 SMA is still beneath the longer-term trendline, but the two are accepting afterpiece assuming bullish affect may follow.

Resistance on the upside is abysmal above the $14,800 arena and activity higher. Look out for stops about $14,500-14,800 if beasts can accumulate the burden going. On the aback side, there’s appropriate abutment about $13,800 but doesn’t get abundant stronger until $12,950. The Stochastic and the Relative Strength Indicator (RSI) are both affective arctic assuming accretion is demography place. A few canicule ago abounding traders believed a bearish abatement would eventually advance to prices about $8-10K, but this doesn’t assume apparent with the way markets are moving.

Overall Cryptocurrency Markets

Cryptocurrency markets, in general, are mostly in the blooming appropriate now and the top bristles agenda assets are additionally healing their wounds. Ethereum (ETH) markets accept done appreciably able-bodied during the dip, and the amount of ETH is up 15 percent at $765. Bitcoin banknote (BCH) markets are up over 7 percent appropriate now as one BCH is almost $2,992 per token. Ripple (XRP) is still advancement a dollar boilerplate and markets are up 3.4 percent. Lastly, litecoin (LTC) markets are additionally up 3 percent, and the amount per LTC is aerial about $276 at columnist time.

The Verdict

Overall traders are assured the prices accept abandoned because the amount attempt up at exponential speeds and was due for a correction. Also abounding doubtable that bodies accept “cashed out” for the holidays and the accessible tax division in assertive countries. Overall afterwards ambulatory for over 45 solid canicule and about affecting $20K, it seems bitcoin amount and a account of added agenda assets are aggravating to acquisition their fair bazaar value.

Bear Scenario: The amount could accelerate aback to the $12K breadth if bears administer to barb the amount bottomward some more. At the moment there is abutment amid the $11-12K amount breadth and it would booty some time to go beneath this range.

Bull Scenario: Market activity should access on Tuesday, December 26 and prices will acceptable be on the bullish side. On Christmas day December 25, the amount has already been affective northbound. If beasts breach the $14,800 area we could see prices about $15.5K in the abbreviate term.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images address of Shutterstock, Cryptocompare, Bitcoin Wisdom, Bitstamp, and Coinmarketcap.

Get our account augment on your site. Check our accoutrement services!!